编者按

2022年12月15日,由国浩律师携手欧洲华人律师协会(ACLE)主办的“中欧经济合作与发展法律服务交流会”在比利时布鲁塞尔成功举办,国浩金融业务委员会副主任、国浩深圳合伙人薛义忠应邀为其中的“金融合作与监管和数据保护与合规”分会场作了《新时代下的中国跨境担保法律制度实务》主题发言。今天我们为您推荐他的精彩演讲。

On December 15, 2022, the "China-Europe Exchange on Economic Collaboration and Development Legal Services Conference" hosted by Grandall lawyers and the Association for Chinese Lawyers in Europe (ACLE) was successfully held in Brussels, Belgium, and Yizhong Xue, Deputy Director of Grandall Banking & Finance Committee and Partner of Grandall Shenzhen Office, was invited to deliver a keynote speech on "Cross-border Guarantee under China’s Legal System in the New Era" at the parallel session of "Financial Partnerships and Regulations, and Data Protection and Regulations". Today we recommend his wonderful speech for you.

In September and October 2013 respectively, President Xi Jinping proposed the cooperation initiative of building "New Silk Road Economic Belt" and "21st Century Maritime Silk Road”. These two are collectively called "One Belt One Road”, which showed China’s open-up policy has come into a new era.

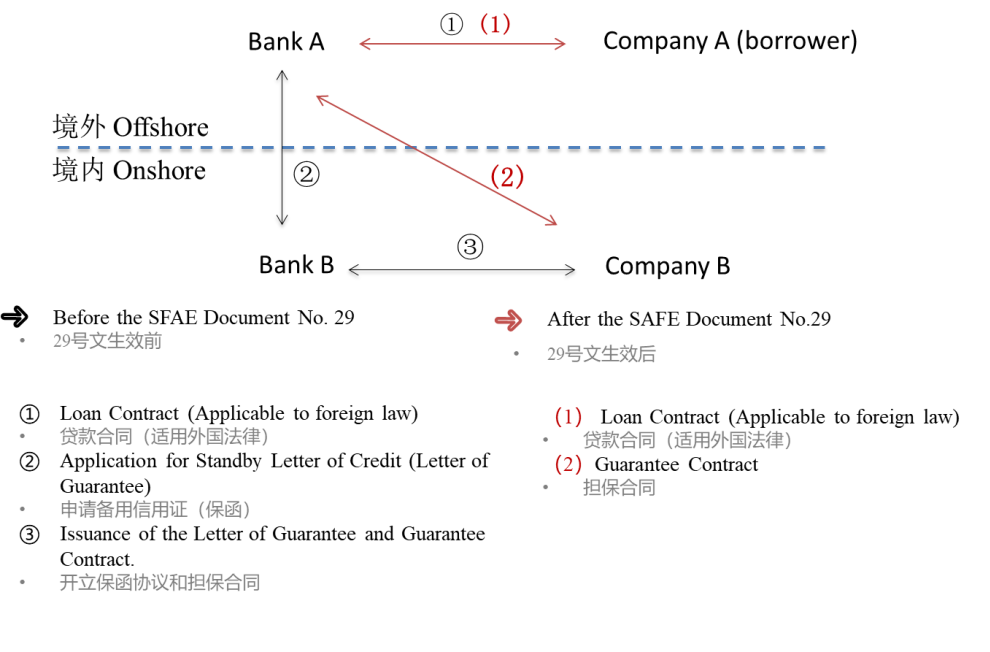

As an essential part of China’s open-up policy and commitment to WTO, China’s financial open-up is highly concerned by the world, of which China’s cross-border guarantee management was urged to transform from the old-fashioned mode. In 2014, the State Administration of Foreign Exchange of People’s Republic of China (“SAFE”) promulgated the Provisions on Foreign Exchange Control for Cross-border Guarantees (“the ‘SAFE No.29 Document’”), embarking a major step forward.

Ⅰ. Transformation Stages of the Management Mode of Cross-border Guarantee

Before the SAFE No.29 Document, China’s previous regulations on cross-border guarantee management generally consisted of two stages, the stage of "Foreign Exchange Guarantee” and the stage of "External Guarantee".

The first stage "Foreign Exchange Guarantee" started from 1987 to 1996. The People's Bank of China issued the Administrative Measures on the Provision of Foreign Exchange Guarantees by Domestic Institutions in 1987, in which the concept of "Foreign Exchange Guarantee" was first proposed. This Administrative Measures provided the qualification and capability of providing cross-border guarantee was subject to the total amount of foreign exchange owned by the guarantor itself.

The second stage "External Guarantee" started from 1996 to 2014. In 1996, The People's Bank of China issued the Administrative Measures on Securities Given to Foreign Parties by Domestic Institutions. This is first time that China proposed the definition of "External guarantee", which means an undertaking that is to be given by a China’s domestic entity (i.e. in the capacity of security provider) to an entity outside the territory of onshore China or to a foreign-funded financial institution within the territory of onshore China (i.e. in the capacity of creditor), under which in case the debtor fails to repay any debt in accordance with agreement, the security provider will perform the obligation of repayment.

Each regulation in the previous two stages has played a positive role in promoting China’s economic cooperation with the foreign world, supporting the development of international trade, and smoothly carrying out foreign financial activities.

However, with the rapid growth of China's foreign-related economy, the scale of balance of payments in international transactions has continuously been expanded, and the structure of cross-border guarantees has been increasingly diversified and complex. Gradually, the above previous regulations, which did not accommodate various types of cross-border guarantees, were no longer able to meet the market development needs. At the same time, the SAFE related guarantee management rules had many approval procedures, which was lagging the market demand and was of high cost.

On May 19, 2014, SAFE adjusted the management mode, simplified its administration and decentralized its power, and finally issued the “SAFE No.29 Document” in due course, so as to facilitate cross-border guarantee activities, which has embarked the current stage of "Cross-border Guarantee".

Ⅱ. New Highlights of the SAFE No.29 Document

1. New Definition

No. 29 Document puts forward the concept of "Cross-border Guarantee", which means a legally binding guarantee made in writing by the guarantor to the creditor to undertake performance of the relevant payment obligation pursuant to the agreement in the guarantee contract and to guarantee a possible international balance of payment transaction such as cross-border payment of funds or cross-border transfer of ownership of assets etc.

2. New Classification

Considering various forms of cross-border guarantees in commercial activities, No. 29 Document divides into three categories:

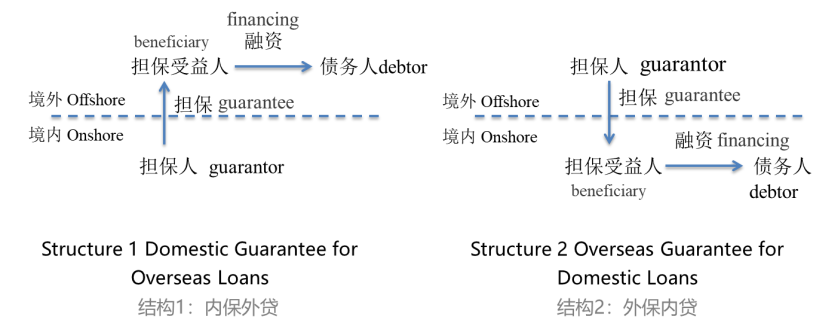

A domestic Guarantee for Overseas Loans means a cross-border guarantee whereby the guarantor is registered in China, whereas the debtor and the creditor are both registered overseas.

An overseas Guarantee for Domestic Loans means a cross-border guarantee whereby the guarantor is registered overseas, whereas the debtor and the creditor are both registered in China.

A Cross-border Guarantee in Any Other Form means any other cross-border other than the aforesaid domestic guarantee for overseas loans and overseas guarantee for domestic loans.

3. New Management Mode

(1) Domestic Guarantee for Overseas Loans:

the parties sign the guarantee agreement by themselves

↓

register the Domestic Guarantee for Overseas Loans with SAFE

↓

in case of performing the guarantee agreement, register the external creditor's rights

↓

deregistration with SAFE

From the above we can see:

l No. 29 Document cancels the quantity control of Domestic Guarantee for Overseas Loans, and cancels the prior approval or indicator verification of domestic institutions' financing and non-financing domestic guaranteed overseas loans. Registration has been the main management method.

l No. 29 Document cancels unnecessary qualification conditions. Except for the restrictions generally applicable to all institutions (such as the restrictions on the use of guarantee funds), the qualification conditions on specific parties (such as the ratio of assets and liabilities on the guarantor and the related relationship requirements) or specific transactions has been removed.

l No. 29 Document cancels the approval of guarantee performance. Banks can perform their own domestic guarantees for overseas loans, and non-bank financial institutions and enterprises can also directly perform at their bank by virtue of the guarantee registration certificate issued by SAFE, and enterprises thereafter shall complete registration formalities for creditor of foreign debt's rights pursuant to relevant SAFE provisions.

(2) Overseas Guarantee for Domestic Loans:

the parties sign the guarantee agreement by themselves

↓

data submitted by the PRC domestic bank

↓

in case of performing the guarantee agreement, foreign debt registration

↓

collection of proceeds after performance

From the above we can see:

l Under this kind of business, the creditor is a domestic financial institution, and the debtor is a non-financial institution. The guaranteed debt can only be ordinary loans or credit lines in RMB or foreign currencies.

l No. 29 Document centralizes registration of creditors. Creditors (i.e. domestic financial institutions) shall report data to the SAFE through their own capital account information system.

l The creditor can collect guarantee performance payment by itself after performance from an overseas guarantor. After the guarantee performed, the domestic debtor shall complete foreign debt registration formalities pursuant to the requirements of SAFE upon settlement of guarantee performance.

(3) Cross-border Guarantee in Any Other Form:

the parties sign the guarantee agreement by themselves

↓

no SAFE registration required

↓

in case of performing the guarantee agreement, no performance approval required, and the party may directly apply to the domestic bank for collecting payment

From the above we can see:

-

Except for the Domestic Guarantee for Overseas Loans and the Overseas Guarantee for Domestic Loans which need to go through the necessary SAFE registration procedures and comply with certain qualification conditions, PRC domestic institutions can sign other forms of cross-border guarantee agreements on their own.

-

What should be emphasized is that for other forms of cross-border guarantee agreements, the SAFE No.29 Document only removes the restriction on the guarantee signing process, but the creditor's claim for the guarantee right and the guarantor's performance of the guarantee obligation should still comply with the foreign debt, direct investment and securities investment regulations of the PRC.

4. Significance of the SAFE No.29 Document

The significance of No.29 Document can be summarized at four factors.

The first is SAFE streamlined administration and delegated power. The SAFE No.29 Document cancels or significantly reduces the quantity control and registration scope of cross-border guarantees, and only includes the liabilities of "certain cross-border guarantees that make residents” or claims against “non-residents appearing after guarantee performance" into the registration scope on case by case basis.

Second, SAFE transformed its functions. The SAFE No.29 Document reasonably defines the scope of foreign exchange management and the boundary of regulatory responsibility for cross-border guarantees. The cross-border guarantees with the following four characteristics are included under foreign exchange management: (1) compliance with legal requirements, (2) money payment as the guarantee performance method, (3) relatively determined performance amount, and (4) possible significant impact on PRC international income and expenditure. At the same time, No.29 Document fully respects the superior law, international practices and market demand, and decouples the foreign exchange management from the validity of cross-border guarantee agreements. From the perspective of purpose and effectiveness, SAFE’s responsibility of international balance of payments statistics is different from the confirmation registration, and therefore should not be an element for the guarantee to become effective or to be against a third party.

The third is the shift from pre-approval to post supervision of SAFE. SAFE No.29 Document cancels all prior approvals and registrations as the main management method, and replaces them with proportional self-check and registration.

Fourth, SAFE No.29 Document realizes the unification of foreign exchange management policies for cross-border guarantees and the basic convertibility of cross-border guarantees. That is to say: in the field of Domestic Guarantee for Overseas Loans, whilst canceling prior approval of guarantees and the approval of guarantee performance and other qualification conditions, individual case of registration of signing agreement are still retained; and in the field of Overseas Guarantee for Domestic Loans, on the condition that relevant restrictive conditions are met, Chinese and foreign-funded enterprises are allowed to enter into agreements on their own, and make guarantee performance within the scope of double of their net assets, which unifies and improves the Overseas Guarantee for Domestic Loans of Chinese and foreign-funded enterprises.

Ⅲ. Opportunities for Cross-border Lawyers

Under the current PRC legal system of cross-border guarantees, how can onshore and offshore banks and enterprises make benefit to meet their commercial needs of investment and financing? What services can PRC lawyers provide?

On the one hand, China’s financial open-up make cross-border financing business much more popular in the market, creating more opportunities for cross-border lawyers. On the other hand, the participation of lawyers can assist enterprises and banks in cross-border transactions to successfully complete financing and reasonably control or reduce legal risks.

1. to assist the parties in designing the transaction structure

Different subjects, transaction purposes and transaction backgrounds determine that cross-border guarantee business has different physical conditions and procedural requirements. A lawyer needs to have a full understanding of the parties’ needs and advise on the most legitimate way to obtain international financing and guarantees and to allow parties to maximize their commercial purpose.

2. to conduct due diligence and issue legal opinions

A cross-border transaction should be duly carried out based on the principle of prudence, which means it should conform to domestic and foreign laws and regulations, transaction purposes, security interests, etc. Therefore, it is very necessary to retain professional lawyers to conduct due diligence on the legitimacy of commercial purposes, transaction background, source of funds, all kinds of guarantee measures, nature of collateral, legal risks of performance, etc. Through the objective and neutral investigation report, lawyer as a third party can disclose possible risks to the guarantor, and provide professional and reasonable optimization suggestions. In particular, when onshore banks issue financing letters of guarantee or standby letters of credit for enterprises, the structure of property right and the method of counter guarantee, and the verification of the authenticity and effectiveness of counter guarantee by lawyers, will be key part in the completion of the transaction.

3. to participate in cross-border financing negotiations and to prepare transaction documents

Negotiations happen in the preparation of transaction and during the performance of agreement as well. Lawyer’s participation in negotiations can help the parties to conduct a more comprehensive assessment of legal risks and help the parties to make reasonable decisions. Professional lawyers can participate in document preparation, witness and notarization to facilitate the smooth completion of the transaction.

4. to assist in attending to cross-border guarantee formalities

Cross-border guarantees usually need to go through government formalities such as signing registration, creditor's rights registration, deregistration, etc. Especially for non-bank institutions, enterprises and individuals who have to communicate with various government departments and handle complex procedures, lawyer’s participation can make up the inexperience of the parties and quickly respond to government requirements, which makes the transaction more convenient and more smooth and ensures its authenticity and legality.

作者简介

薛义忠

国浩深圳合伙人

业务领域:金融、并购重组、资本市场

邮箱:xueyizhong@grandall.com.cn